Power Nickel's flagship NISK project is a carbon-neutral source of high-grade nickel and other battery metals.

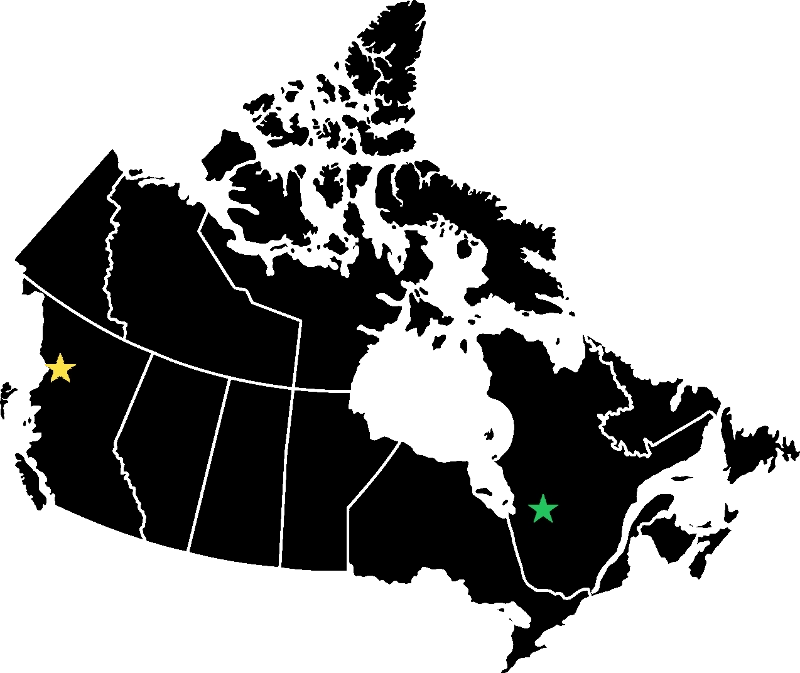

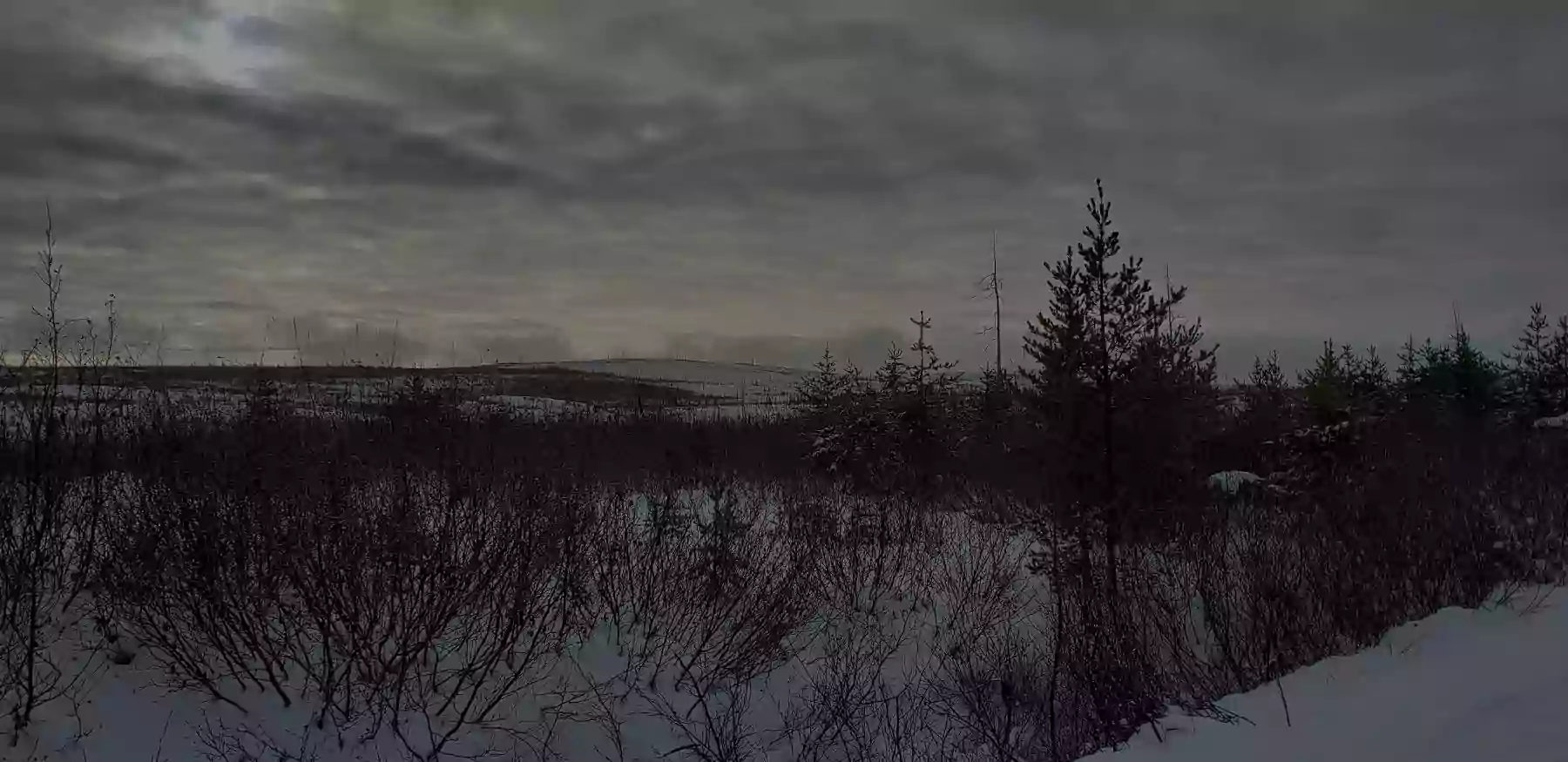

Located in Quebec, Canada the NISK project benefits from an abundant supply of low-carbon hydropower and carbon-capture technology that uses NISK's ultramafic tailings to help offset the mine's emissions.

- Carbon-Neutral: Carbon capture technology using the ultramafic tailings found at NISK can be used to sequester more carbon than the project will emit. Read our ESG & Sustainability Report

- High-Grade: NISK contains high-grade class-1 nickel with intercepts including 18.5m of 2.00% NiEQ and 26.6m of 1.98% NiEQ. See our highlights and full dataset.

- Low-Cost: Access to inexpensive and abundant hydropower from a Hydro-Québec substation across the road, plus generous tax incentives and a shallow mineral depth.

- World-Class Mining Jurisdiction: The Quebec and Canadian governments combined offer tax credits that cover 50% of exploration cost, which means Power Nickel can spend $2 exploring for every $1 invested.

- Established Infrastructure: NISK is located beside a major highway with a Hydro-Quebec substation across the road and a nearby town with an airport.

- Mineralizations for Multiple Battery Metals: High-grade intercepts for Nickel, Copper, Cobalt, Palladium and Platinum; such as 7.75m of 1.47% Copper, 5.71g/t Palladium and 20.76g/t Platinum, including 1.75m of 3.90% Copper, 19.97g/t Palladium and 90.60g/t Platinum.

2024 Roadmap

Next Steps for Power Nickel

Expand Nisk Resources

- Q1 2024: Begin testing potential new pods ANT 1-4 for mineralization to add new zones to NISK Main.

- Throughout 2024: Continue exploration with dedicated drilling rigs for each pod, aiming to increase resources and enhance geological understanding, building on the recently published NI 43-101 of 7.2 million tonnes including 5.43 million tonnes (Indicated) and 1.79 million tonnes (Inferred).

Complete CVMR Feasibility Study

- Q1 2024: Receive results of benchmark studies conducted by CVMR.

- Q2 2024: Obtain prototype results.

- Q3 2024: Finalize and release the CVMR Feasibility Study report, potentially highlighting a 30% improvement in mineral recovery.

Spin Out Copper and Gold Assets into a Newco via a Plan of Arrangement

- Q1 2024: Announce terms of the Plan of Arrangement.

- Q2 2024: Complete the Plan of Arrangement, expecting to secure funding for initial plans and utilize Ambient Noise Tomography in Chile.

Complete Sale of Royalty at Teck Owned Copaquire

- H1 2024: Aim to finalize the sales process for existing royalty rights on the Copaquire project.

Complete Sale of 10% Stake in Power Nickel and 10% Offtake at Power Nickel to Industry

- H1 2024: Finalize the sale of a 10% stake and a 10% offtake agreement on NISK's production, leveraging funding benefits from Canadian tax incentive programs.

Continue to Vigorously Defend Shareholders from Predatory Short Sellers

- Ongoing 2024: Maintain legal and advocacy efforts against illegal short selling practices, working with regulatory bodies and industry groups.

Nisk Project Mineral Resource Estimate

| Class | Potential Mining Method | In-Situ Material Content | Calculated | ||||

|---|---|---|---|---|---|---|---|

| Tonnage | Ni | Co | Cu | Pd | NiEq | ||

| t | t | t | t | oz | t | ||

| Indicated | Open Pit | 519,000 | 0.63 | 0.04 | 0.30 | 0.56 | 0.84 |

| Underground | 4,910,000 | 0.78 | 0.05 | 0.42 | 0.78 | 1.07 | |

| Inferred | Underground | 1,787,000 | 0.98 | 0.06 | 0.45 | 1.11 | 1.35 |

| Class | Potential Mining Method | In-Situ Grade | Calculated | ||||

| Tonnage | Ni | Co | Cu | Pd | NiEq | ||

| t | % | % | % | g/t | % | ||

| Indicated | Open Pit | 519,000 | 3,300 | 200 | 1,600 | 9,400 | 4,400 |

| Underground | 4,910,000 | 38,300 | 2,400 | 20,500 | 123,100 | 52,300 | |

| Inferred | Underground | 1,787,000 | 17,500 | 1,100 | 8,100 | 64,000 | 24,100 |

- NiEq = Nickel Equivalent, Ni = Nickel, Cu = Copper, Co = Cobalt, Pt = Platinum, Pd = Palladium, Au = Gold, Ag = Silver, % = Percent, g = Gram, t = Metric tonne

- The information contained in the table above is derived from the technical report titled "Amended and Updated NI 43-101 Technical Report and Updated Mineral Resource Estimate for the Nisk Project, Eeyou Istchee James Bay Territory, Québec" dated November 2023. The key assumptions, parameters, and methods used to prepare the mineral resource estimates are set out in the linked technical report.

- The independent qualified persons for the 2023 MRE, as defined by National Instrument ("NI") 43- 101 guidelines, are Pierre-Luc Richard, P.Geo. of PLR Resources. Jeffrey Cassoff, P.Eng. of BBA is the independent qualified person for the Pitshell analysis and cut-off grades calculation. Gordon Marrs, P.Eng. of XPS is the independent qualified person for Metallurgy and Smelter Costs. The effective date of the 2023 MRE is November 26, 2023.

Recent News

April 15, 2024

Power Nickel Releases Initial Assay on New Crown Jewel Discovered on its NISK Project

March 20, 2024

Power Nickel Continues to Expand its Near Surface High-Grade Cu-Pt-Pd-Au-Ag Zone 5km Northeast of its Main Nisk Deposit

March 4, 2024

Power Nickel Defines Initial Volume on its High-Grade Cu-Pt-Pd-Au-Ag Zone 5km Northeast of its Main Nisk Deposit

Canadian Projects

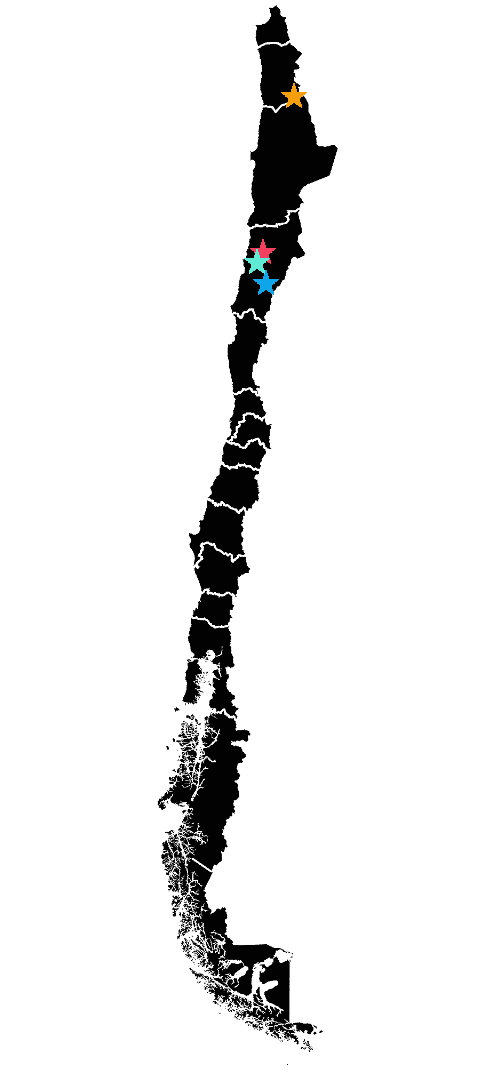

Chilean Projects

3% Copaquire Royalty

Chile

Copaquire is a Copper Moly deposit held by Teck Resources. Located in Chile, Copaquire adjoins Teck's nearly-depleted Quebrada Blanca copper mine and is expected to be brought into production in the near future. Upon production, this 3% royalty will provide Power Nickel subsidiary Consolidation Gold and Copper with recurring cashflow.