© Copyright – Chilean Metals

Developing Four Significant Resource Projects Located in BC’s Golden Triangle and in Northern Chile’s Mining Belt

Chilean Metals Inc. holds 100% interest in four highly prospective Gold, Silver and Copper Mineral Properties, one in the Golden Triangle of BC and three in Chile’s Atacama Mining Region.

Chilean Metals Inc. – Four Projects with Substantial Gold, Silver and Copper Resource Potential

Chilean Metals is a dynamic Canadian junior exploration company, is strategically positioned for success as it focuses on unlocking the potential of gold (Au), silver (Ag), copper (Cu), and iron (Fe) prospects in Canada and Chile. Stemming from the well-established Power Metallic Mines Inc. (TSXV: PNPN • OTCQB: PNPNF • Frankfurt: IVV), this spin-off is gaining momentum. With a portfolio of four projects, including one in British Columbia, Canada, and three in Northern Chile, Chilean Metals presents a compelling investment opportunity in the thriving mining sector.

Chilean Metals Inc. – Four Projects with Substantial Gold, Silver and Copper Resource Potential

Chilean Metals is a dynamic Canadian junior exploration company, is strategically positioned for success as it focuses on unlocking the potential of gold (Au), silver (Ag), copper (Cu), and iron (Fe) prospects in Canada and Chile. Stemming from the well-established Power Metallic Mines Inc. (TSXV: PNPN • OTCQB: PNPNF • Frankfurt: IVV), this spin-off is gaining momentum. With a portfolio of four projects, including one in British Columbia, Canada, and three in Northern Chile, Chilean Metals presents a compelling investment opportunity in the thriving mining sector.

Golden Ivan Located in the Golden Triangle – An Area Historically Abundant with Gold and Silver

Welcome to the Golden Triangle’s hidden gem – the Golden Ivan property. Nestled in the heart of British Columbia’s mining haven, this strategic acquisition from Granby Gold Inc opens the door to a future brimming with gold opportunities. With a commitment to invest $1.8 million in exploration over the next four years and boasting 100% ownership, our Golden Ivan property is strategically located near proven deposits like Red Mountain and Premier Gold. It’s also directly adjacent to the prolific, high grade, past producing Porter Idaho mine. Accessible by helicopter from Stewart, a mineral exploration hub, our property opens doors to high-alpine treasures and potential riches. Positioned within the Stikine Terrane, it holds promise with felsic to intermediate volcanogenic sediments, historic polymetallic showings, and proximity to significant fault lines. Join us in unlocking the wealth of over 130 million ounces of gold in the Golden Triangle – an opportunity for growth, exploration, and prosperity.

Ounces of Gold in the Golden Triangle

Golden Ivan Located in the Golden Triangle – An Area Historically Abundant with Gold and Silver

Welcome to the Golden Triangle’s hidden gem – the Golden Ivan property. Nestled in the heart of British Columbia’s mining haven, this strategic acquisition from Granby Gold Inc opens the door to a future brimming with gold opportunities. With a commitment to invest $1.8 million in exploration over the next four years and boasting 100% ownership, our Golden Ivan property is strategically located near proven deposits like Red Mountain and Premier Gold. It’s also directly adjacent to the prolific, high grade, past producing Porter Idaho mine. Accessible by helicopter from Stewart, a mineral exploration hub, our property opens doors to high-alpine treasures and potential riches. Positioned within the Stikine Terrane, it holds promise with felsic to intermediate volcanogenic sediments, historic polymetallic showings, and proximity to significant fault lines. Join us in unlocking the wealth of over 130 million ounces of gold in the Golden Triangle – an opportunity for growth, exploration, and prosperity.

Ounces of Gold in the Golden Triangle

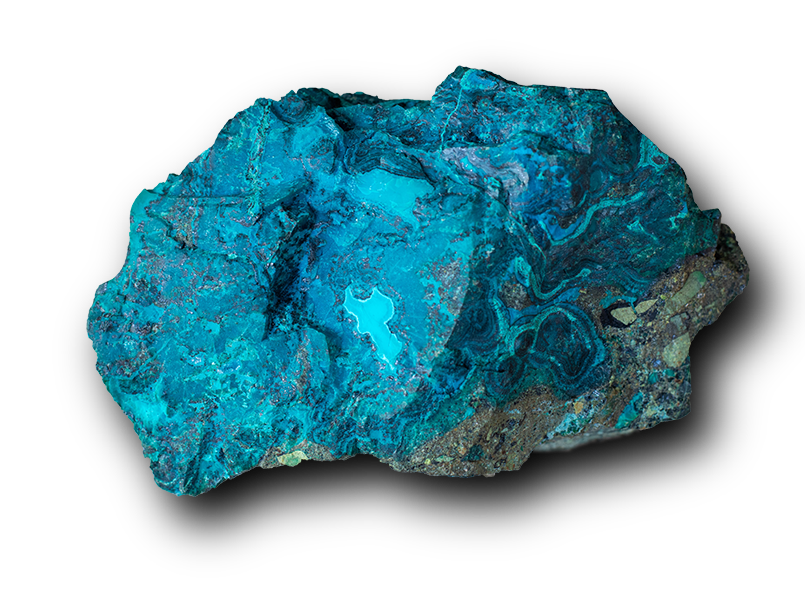

Three Projects in Chile’s Atacama Mineral Rich Region Close to Lundin Mining’s Candelaria IOCG Mine

Chilean Metals operates three projects in Chile’s Atacama Region, strategically located near Lundin Mining’s Candelaria IOCG mine. The Palo Negro Property, covering over 6,672 acres, sits along the Atacama Structural Zone, known for high-grade Cu, Au, Ag, and Fe deposits, in close proximity to the Candelaria deposit. The Tierra de Oro (TDO) property, wholly owned by Chilean Metals, is positioned in Chile’s prolific IOCG belt, neighboring the Candelaria deposit with significant reserves. With convenient access from Copiapo and a well-connected airport, these ventures present an enticing investment opportunity in a region rich in mineral resources.

Investor Signup

Investor Signup

Last but not least…

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam egestas a nulla a molestie. Duis a sapien ac orci dictum sodales. Vivamus vitae feugiat elit. Fusce a eros laoreet, bibendum lectus id, euismod nulla.

Planning & Consulting

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam egestas a nulla a molestie. Duis a sapien ac orci dictum sodales. Vivamus vitae feugiat elit. Fusce a eros laoreet, bibendum lectus id, euismod nulla.

Design & Production

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam egestas a nulla a molestie. Duis a sapien ac orci dictum sodales. Vivamus vitae feugiat elit. Fusce a eros laoreet, bibendum lectus id, euismod nulla.

Shipping & Managing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam egestas a nulla a molestie. Duis a sapien ac orci dictum sodales. Vivamus vitae feugiat elit. Fusce a eros laoreet, bibendum lectus id, euismod nulla.